Confirming payment details

Payment processing

Login or Sign up

Forgot password

Enter your email address and we will send you a password reset link or need more help?

UK Cities House Price Index - November 2018

On 20 December, 2018- UK city house price inflation running at 2.6%, lowest annual growth rate for 5 years.

- London house prices register annual price fall for only second time in 23 years.

- UK city house price growth projected to be 2% in 2019 as above average growth in regional cities offsets a 2% price fall across London.

The 20-city index is registering house price inflation of 2.6%, the lowest annual rate of growth for 5 years. House price inflation in London is ending the year with price falls for only the second time in 23 years. Affordability will set the framework for future growth, and we predict 2% house price growth in 2019.

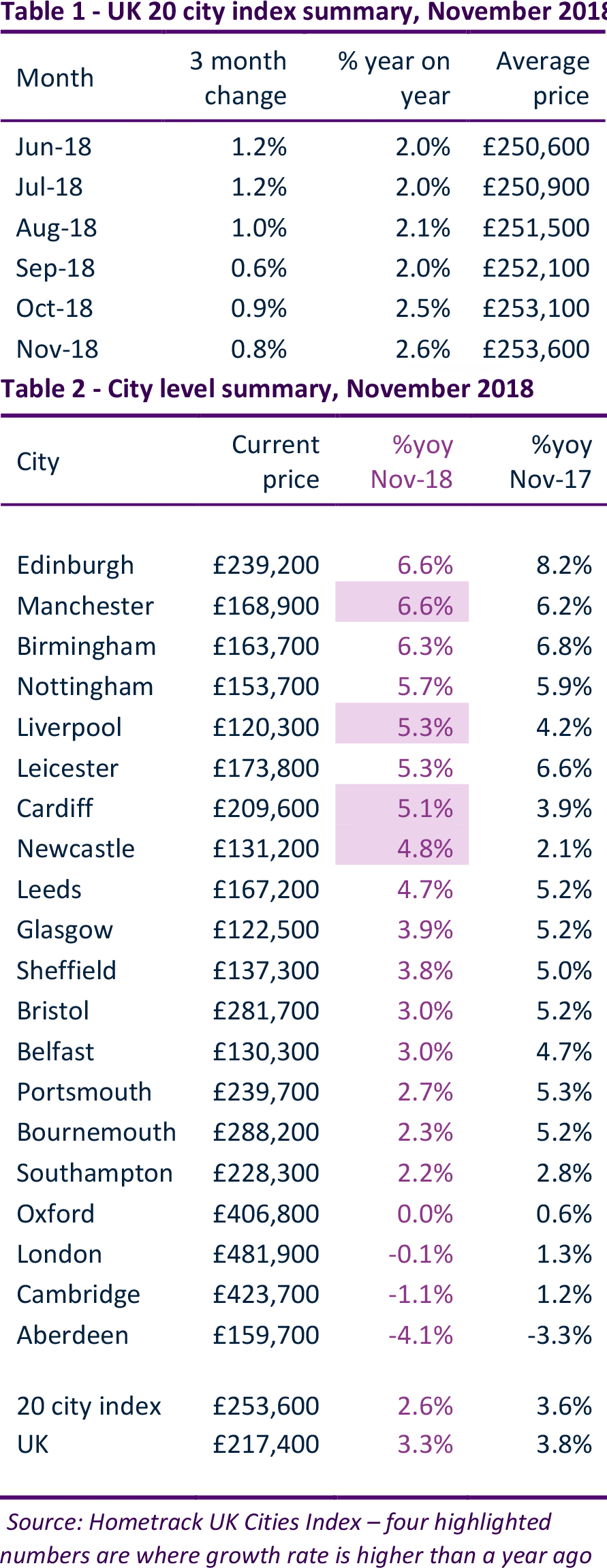

City house price inflation lowest for 5 years

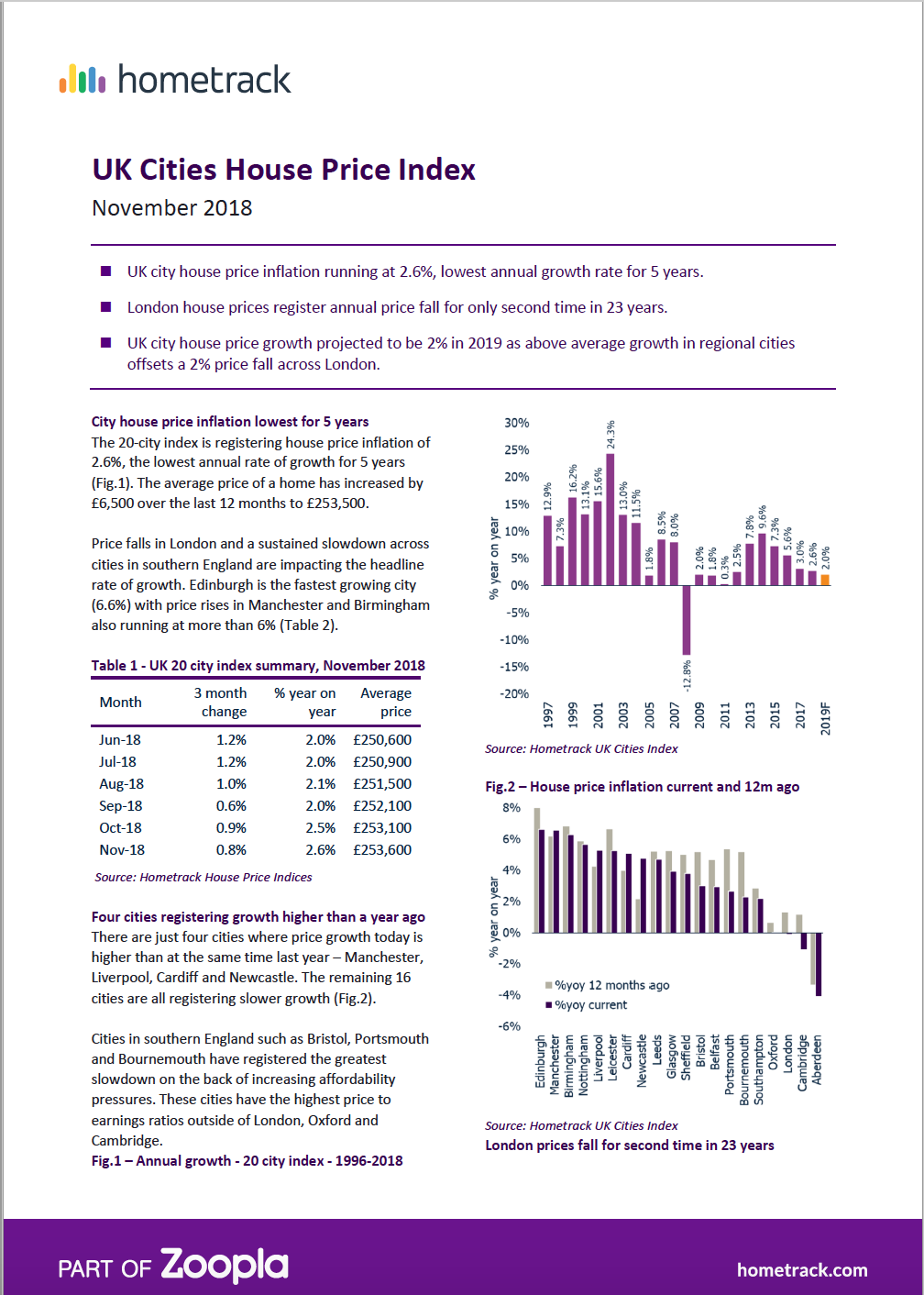

The 20-city index is registering house price inflation of 2.6%, the lowest annual rate of growth for 5 years (Fig.1). The average price of a home has increased by £6,500 over the last 12 months to £253,500.

Price falls in London and a sustained slowdown across cities in southern England are impacting the headline rate of growth. Edinburgh is the fastest growing city (6.6%) with price rises in Manchester and Birmingham also running at more than 6% (Table 2).

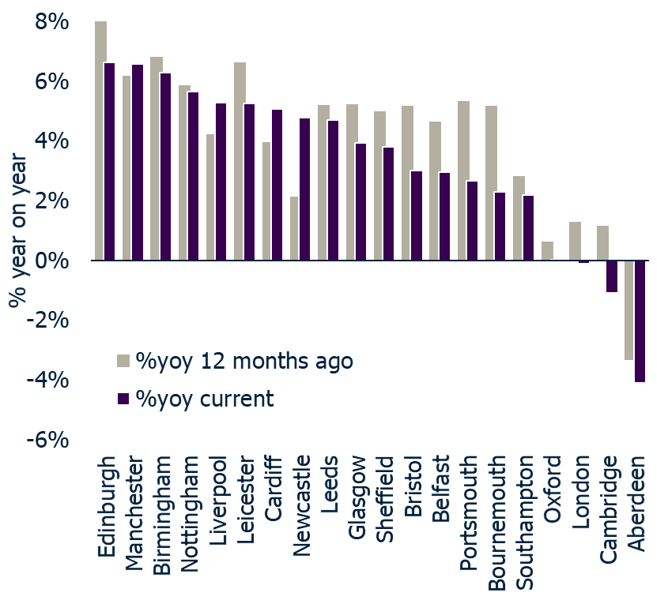

Four cities registering growth higher than a year ago

There are just four cities where price growth today is higher than at the same time last year – Manchester, Liverpool, Cardiff and Newcastle. The remaining 16 cities are all registering slower growth (Fig.2).

Cities in southern England such as Bristol, Portsmouth and Bournemouth have registered the greatest slowdown on the back of increasing affordability pressures. These cities have the highest price to earnings ratios outside of London, Oxford and Cambridge.

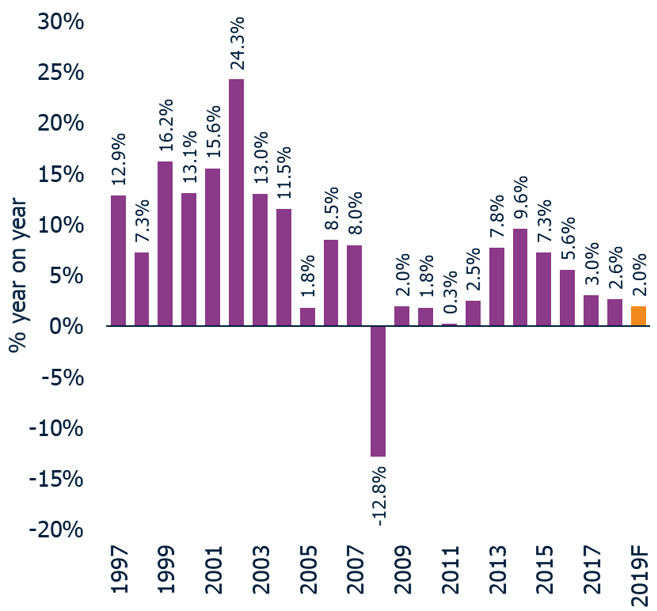

London prices fall for second time in 23 years

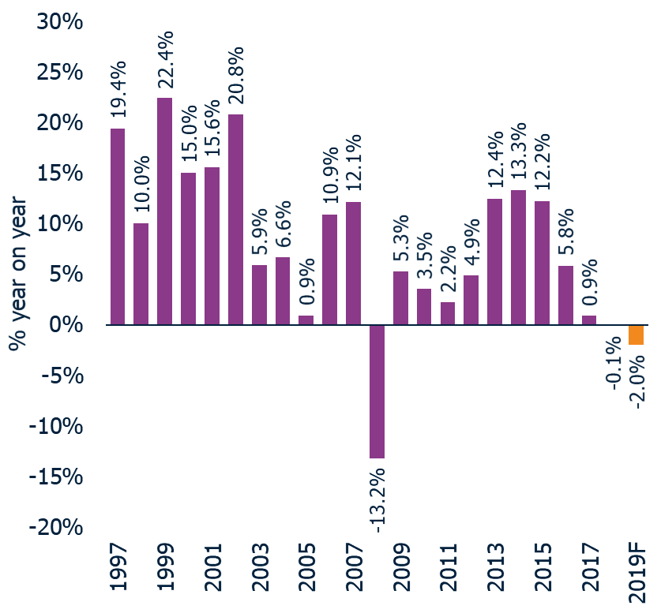

House price inflation in London is ending the year with price falls for only the second time in 23 years (Fig.3). Prices are -0.1% lower, down on +0.9% over 2017 and well short of the long run average of 8.2% per annum.

Stretched affordability, a succession of tax changes and increased uncertainty over the outlook are weighing on both demand and price growth. Recent house price falls are doing little to materially change the affordability picture. The house price to earnings ratio in London peaked at 14x in 2016 and has started to fall but remains extended at 13.3x (Fig. 4).

Stretched affordability a material constraint in London

London is a large and diverse city with many housing markets. There remains a clear divide in growth between low price growth in outer London and the commuter areas while nominal price falls are concentrated in the high value, inner areas of London.

Overall, we expect average house prices across London to fall by 2% over 2019 with continued, above average price falls in higher value areas as buyers remain price sensitive. This will result in the price to earnings ratio falling to 12.9x, still higher than the 17-year average of 11x and returning to levels last recorded in mid-2015.

While levels of mortgage debt are growing, average loan to value ratios for mortgaged property remain low with plenty of scope to absorb price falls over the year.

City price inflation lower than forecast for 2018

A year ago, we forecast that UK city house price growth would be 5% over 2018 with a 3% increase across the UK. The outturn for cities has been weaker than we anticipated, largely a result of slower price growth in regional cities. We were spot on for the UK.

Affordability levels in regional cities outside the south of England remain attractive but house price growth has run well ahead of earnings growth for the last 5 years. Small increases in mortgage rates over 2018, and growing uncertainty, has impacted the speed at which households bid up the cost of housing.

Affordability sets framework for future growth

The fundamentals of housing affordability will shape the prospects for city house prices in 2019 and beyond. This is already the case with flat to falling prices in the most unaffordable cities and above average growth in the more affordable areas (Fig 5).

The speed at which housing affordability translates into price changes depends upon demand side factors influenced by the economic outlook, changes to mortgage rates and household sentiment. Brexit is the greatest driver of uncertainty in the near term and is likely to impact market activity in the early parts of 2019. The housing market is very sensitive to changes in mortgage rates and we expect any changes to be limited.

2% house price growth expected in 2019

Overall, we expect average UK city house prices to increase by 2% over 2019. This factors in a 2% fall in London prices and a continued moderation in the rate of growth across regional cities compared to growth over 2018. We expect house price growth of up to 5% in the most affordable markets such as Liverpool and Glasgow.

Fig.3 – London prices fall for second time in 23 years

UK Cities House Price Index - November 2018

Related articles

The housing market continues to adjust to higher borrowing costs. The summer slowdown is now arriving, tempering activity. The timing of the first cut in the base rate is key and will give a boost to market sentiment and sales activity.

After a busy start to 2022, the market will start to move back to pre-pandemic conditions, allowing supply pipelines to rebuild. However, the demand/supply imbalance will not fully unwind, and this will be one factor supporting price growth of 3% next year.

House price growth is starting to ease, although the path over the next year will not be linear. We expect UK average price growth to end 2022 firmly in positive territory at 3%.

The impact of the pandemic has further to run. The current momentum in the market will largely offset growing headwinds over 2022 with average UK house prices increasing by 3% and 1.2m sales.

Subscribe to receive email updates.

HometrackGlobal:

Linked In: